Join the Carroll Community

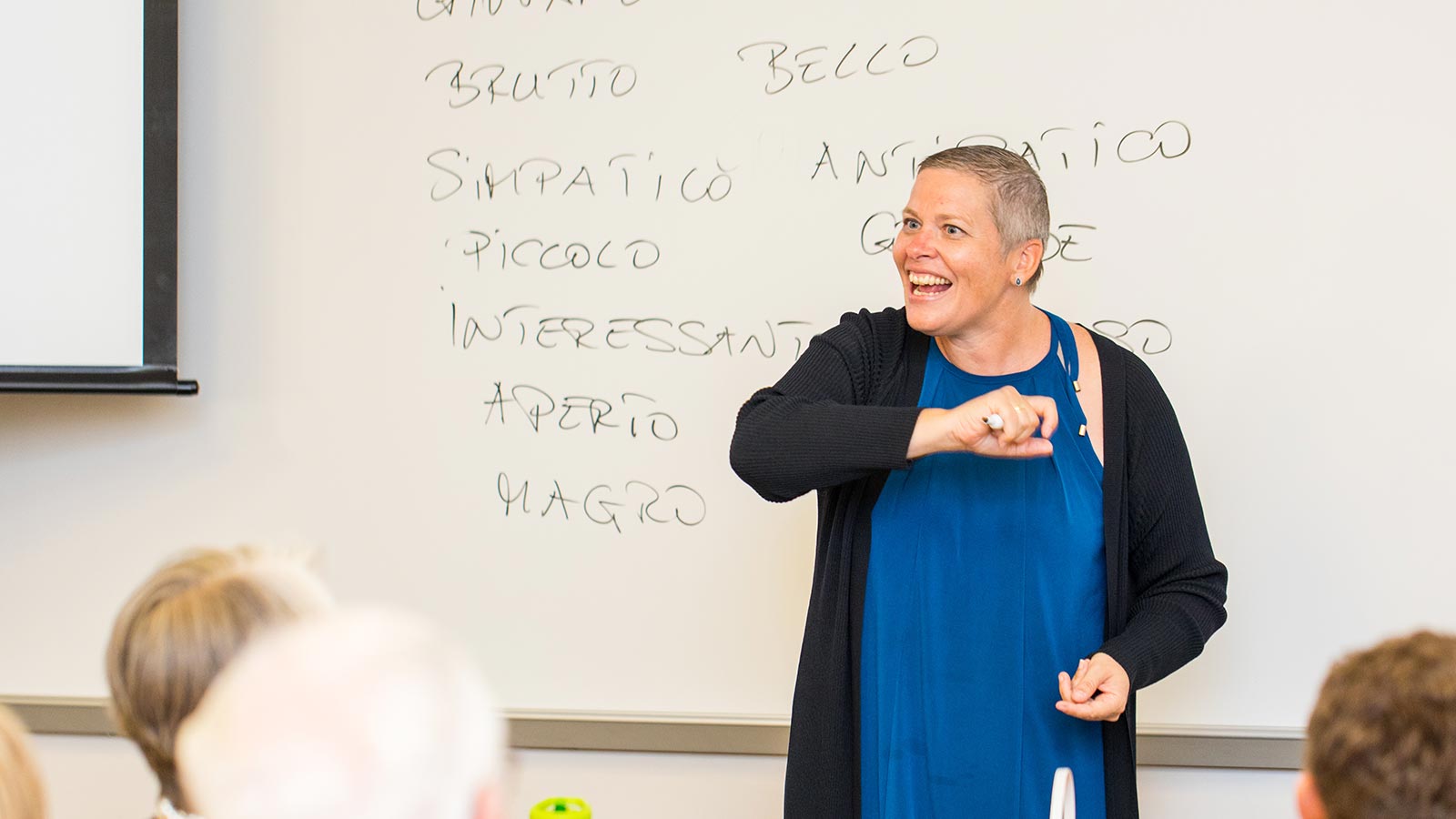

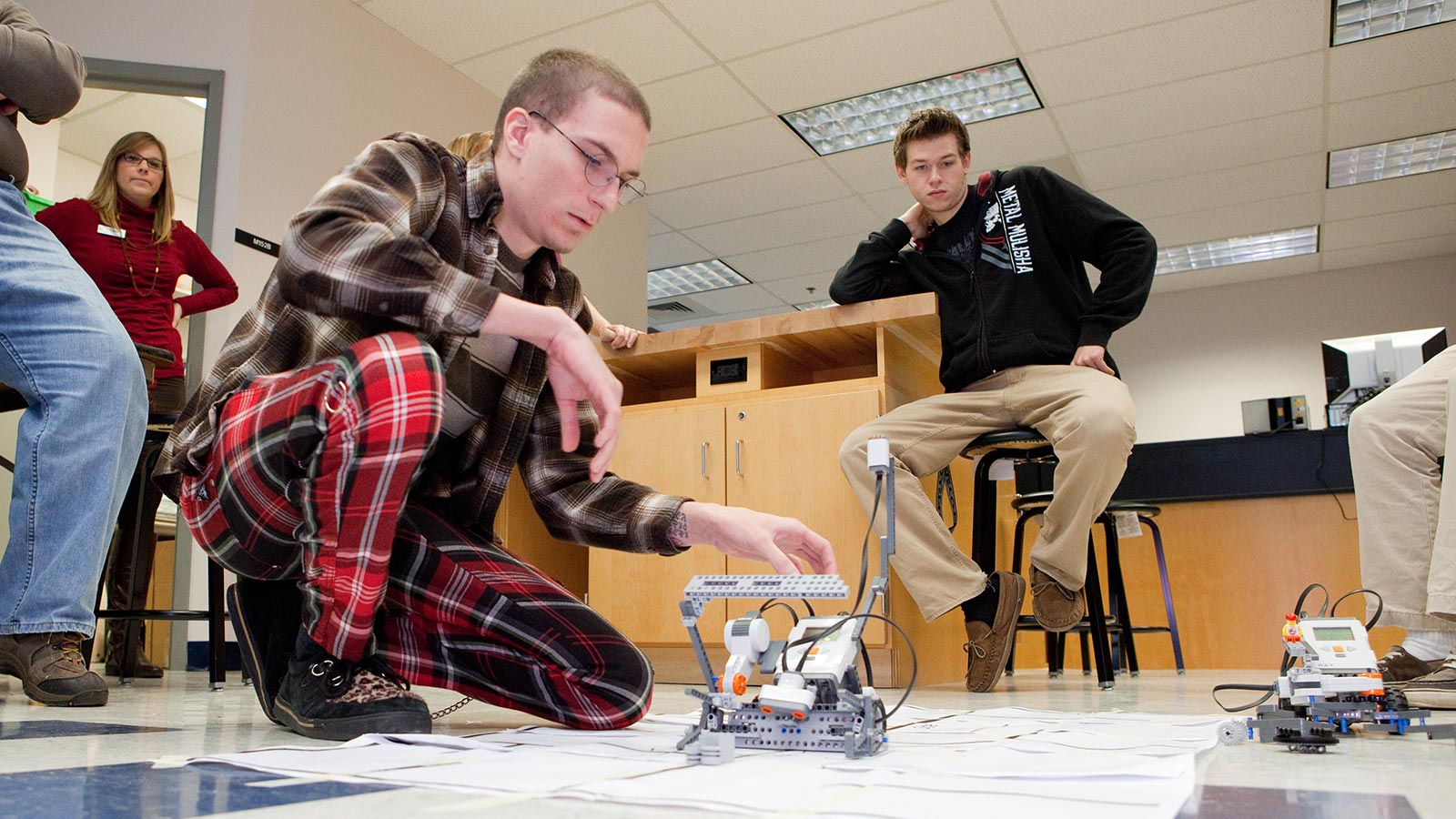

Whatever your academic, career or personal goals, we will help you shape a learning program based on your interests and aspirations.

Carroll provides all the personalized support you need for an enriching and rewarding college experience.

We'll guide you to wherever you're going so you can become the person you wish to be.